Navigating biodiversity financing in 2024: Key considerations for businesses in supporting global conservation efforts

A Sustainability Journey, News, Social & Environmental Services

A Sustainability Journey, News, Social & Environmental Services

This article was contributed by South Pole Australia.

This article is written by Juliana Rademaker and Santiago Martinez. This article is derived from the South Pole blog on their official website.

2024 is shaping up to be the year when companies across the world begin to redefine their relationship with nature.

If we are to protect and restore our natural world and avoid the worst impacts of a sixth mass extinction, the first driven by humans, businesses have a crucial role to play. The Global Biodiversity Framework Kunming-Montreal, sometimes referred to as the Paris Agreement for nature, highlights the responsibility of the private sector in halting the decline of biodiversity and restoring it by 2030.

In this blog, we breakdown the global trends and initiatives in 2024 that businesses taking action on biodiversity, conservation and restoration need to be aware of.

Enhanced biodiversity reporting: toward more consistency across corporate initiatives

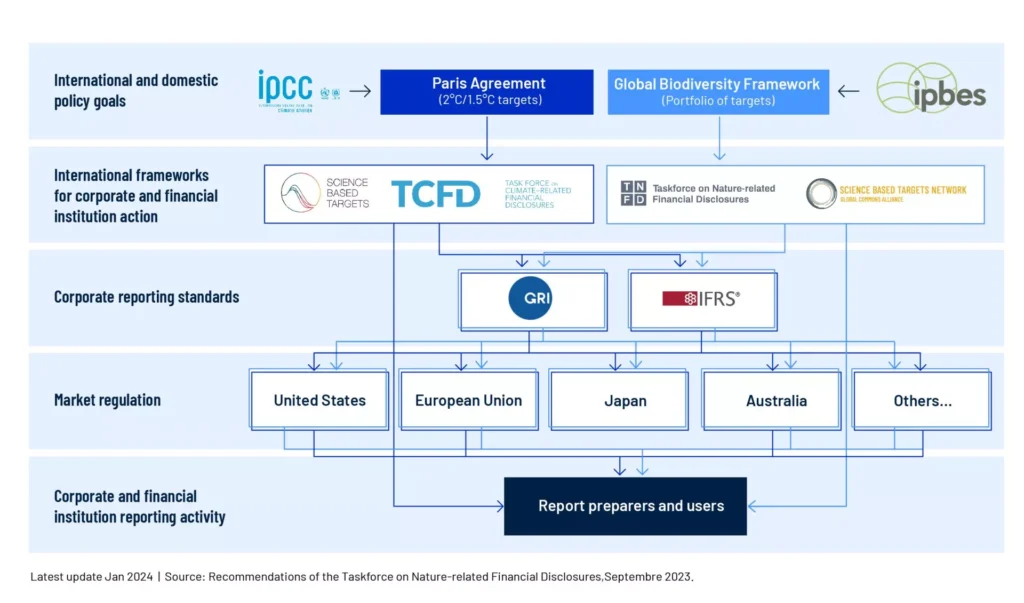

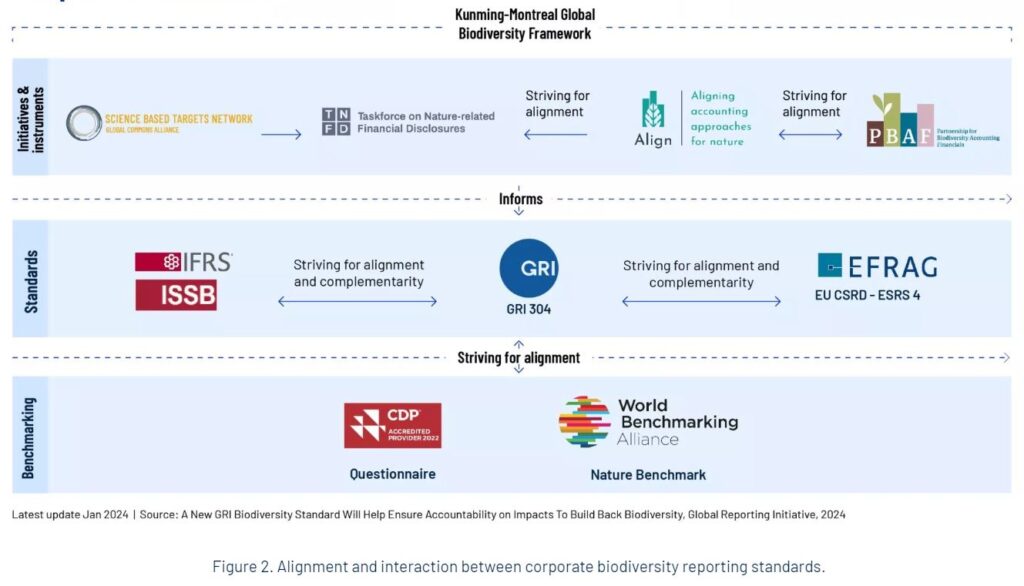

In recent months, a surge of new reporting frameworks and directives have emerged, with a unified goal of enhancing transparency, standardisation and accountability in biodiversity reporting. This has been outlined by target 15 of the Kunming-Montreal Framework. These initiatives are designed to inform and guide stakeholders and investors about the environmental impacts of businesses while encouraging them to adopt more sustainable practices.

A pivotal development in this landscape is the rollout of the EU Sustainability Reporting Standards 4 (ESRS 4) under the Corporate Sustainability Reporting Directive (CSRD). Here, companies operating in Europe will gradually be mandated to report on their biodiversity and ecosystem impacts and dependencies. In addition, companies will have to disclose transition plans, biodiversity and ecosystem targets, and metrics for gauging their progress to limit the impact of their operations and supply chains on natural ecosystems and biodiversity.

Simultaneously, the Taskforce on Nature-Related Financial Disclosures (TNFD) is forging a framework for companies and financial institutions to report and manage their impact on nature, biodiversity, and ecosystem services. At the last Davos summit, the TNFD recently announced its inaugural cohort of early adopters, comprising over 300 organisations committed to initiating disclosures aligned with TNFD Recommendations.

Finally, the International Sustainability Standards Board (ISSB), unveiled during COP 15, plans to define sustainability as intrinsically linked to natural ecosystems within its disclosure standard, the “General Sustainability-related Disclosures Standard” (S1). Leveraging frameworks like the TNFD, the ISSB aims to integrate nature-focused measures into its standards. While currently voluntary, these disclosure standards are slated to become mandatory for jurisdictions adopting these standards.

Embracing multiple coexisting metrics

While businesses aspire to identify a single, comprehensive metric to assess their impact and dependencies on nature, the complex nature of biodiversity requires a nuanced approach. This approach should be tailored to the specific circumstances and locations of each company’s operations.

Instead of waiting for a universal metric, companies should proactively pinpoint location-specific nature interfaces and identify priority risks and opportunities throughout their value chain. This approach enables organisations to evaluate their data and measurement requirements for monitoring performance and understanding how they impact and depend on nature.

Various tools and frameworks, such as the Locate, Evaluate, and Assess Process (LEAP) proposed by the TNFD framework, or the initial steps outlined by the Science Based Target for Nature (SBTN), offer valuable guidance. For instance, the SBTN initiative advocates for a comprehensive mapping of risks and dependencies, identifying key areas of influence and prioritising conservation efforts based on their impact. By adopting this method, companies can effectively select suitable measurement metrics and datasets tailored to their unique circumstances.

In 2024, technological innovation is expected to play a significant role in addressing challenges related to biodiversity metrics. Advances in artificial intelligence, satellite imagery, and data analytics are anticipated to enable more precise monitoring and assessment of biodiversity, empowering organisations to develop targeted conservation strategies. This tech-driven approach aligns with the science-based initiatives advocated by the global biodiversity framework, offering promise for the future of biodiversity measurement and management.

Closing the global biodiversity financing gap

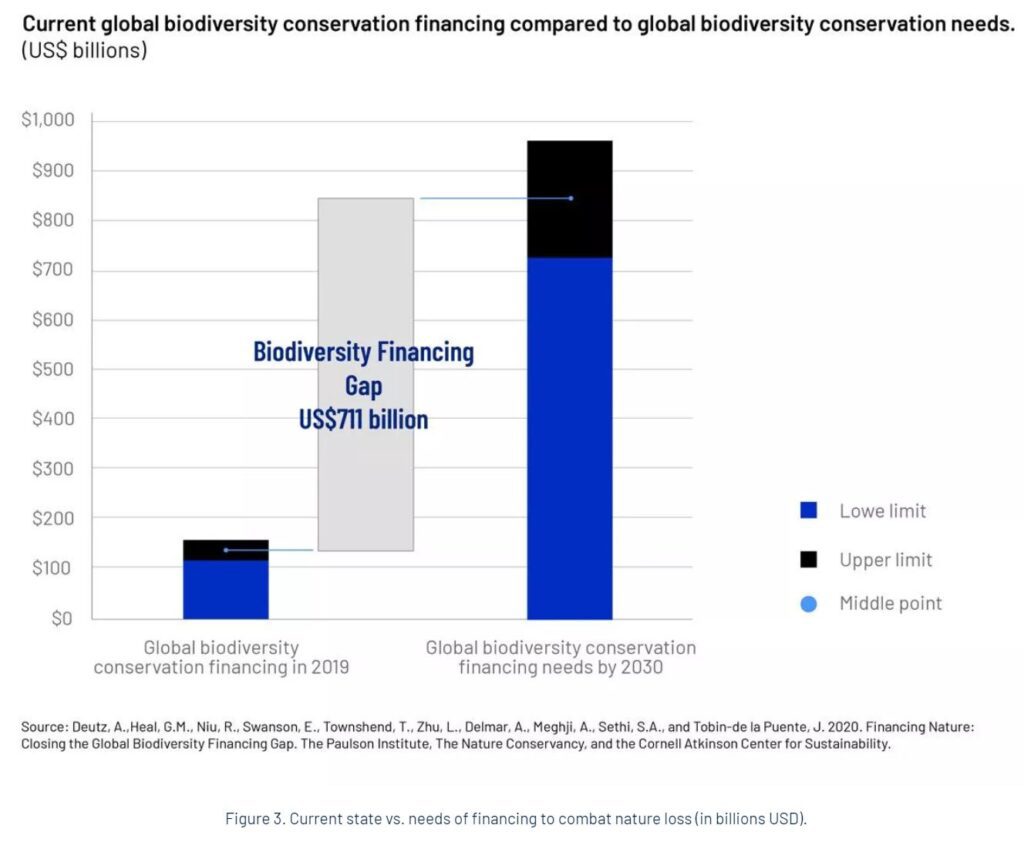

Innovative financial strategies are gaining traction in order to meet Target 19 of the Kunming-Montreal Global Biodiversity Framework (KMGBF). This target highlights the urgent need to raise $200 billion annually for biodiversity conservation, including $30 billion annually from international finance sources. In response, the voluntary biodiversity offset market has emerged as a critical economic tool, aiming to finance conservation and restoration projects.

At the heart of this burgeoning market lies the goal of bridging the daunting biodiversity finance gap, which is estimated to range between $598–824 billion per year. Closing this gap is critical for transitioning towards a nature-positive economic paradigm.

Companies participate in this market for various reasons. Some aim to mitigate their environmental impact, while others seek to showcase their dedication to ecosystem conservation and environmental stewardship. Engaging in biodiversity offsetting allows these companies to distinguish themselves from competitors and appeal to investors, employees, or clients.

In some regions, regulatory requirements also drive corporate involvement in biodiversity offsetting. For example, legislation like the Biodiversity Net Gain (BNG) policy in the UK mandates that developers ensure new projects lead to a net increase in biodiversity, when compared to pre-development levels.

As the voluntary biodiversity offset market matures, its potential to address critical conservation funding needs becomes increasingly evident. For example, the Organisation for Biodiversity Certificate and the Biodiversity Credit Alliance are actively developing credible and scalable offsetting mechanisms. Their efforts focus on advocating for quantification methodologies to accurately measure biodiversity gains and promote robust governance principles to ensure the maximum benefits for nature are achieved.

Could 2024 be an inflection point for corporates taking action on biodiversity?

One clear signal that the tide for nature is turning is that business leaders showcased their commitment to biodiversity conservation at COP15 in Montreal. During this international negotiation, over 330 companies came together under the Make it Mandatory campaign. Recognizing that nearly half of the global GDP relies on nature-dependent economic activities, these leaders understand the private sector’s vulnerability to biodiversity loss.

In addition, we are witnessing a significant surge in companies integrating nature into their core strategies. However, amidst this progress, navigating the complexities of reporting standards, measurement metrics, and financing mechanisms remains challenging. While it won’t be easy, those committed companies have a real opportunity to innovate for our natural world.

For companies seeking to redefine their relationship with nature while safeguarding their operations, our team at South Pole offers clear guidance and support. From understanding impacts to setting scopes, defining approaches, and establishing targets, South Pole can kickstart your journey towards sustainability.

The views and opinions we express here don’t necessarily reflect our organisation.